idaho estate tax return

A return shall be required to be filed with the Commission by every estate that is required by the laws of the. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1158 million in 2020.

But auditsare not just for your income tax returns either â they also apply to estate taxreturnsEstate tax return audits can.

. If you have questions about either the estate tax or inheritance tax call 517 636-4486. Before filing Form 1041 you will need to obtain a tax ID number for the estate. It does not tax Social Security but it does tax retirement accounts including 401ks pension plans and trusts.

Idaho taxpayers whove suffered a disaster loss in Benewah Bonner Kootenai and Shoshone counties because of straight-line winds on January 13 2021 can report the loss amount on Idaho Form 39R. This is a complex task that has different requirements in each state sometimes not having any. The lack of information readily available in this tax area is a huge source of the problems you most likely face when trying to file.

Overall Idaho tax structure. You can start checking on the status of your return within 24 hours after they have received your e-filed return or 4 weeks after you mail a paper return. Go to line 23 Other Subtractions and provide an explanation of the subtraction.

31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a ID state return. There is an 1170 million million exemption for the federal estate tax for deaths in 2021 increasing to 1206 million in 2022. Eymann says the tax commission offices in Coeur dAlene and Lewiston will be open Monday from 9-4 for people who want help in person.

You can expect your refund about 10 to 11 weeks after we receive your return. Letter to IRS requesting prompt audit of estate tax return 347 31. However there are deductions for individuals who are over the age of 65.

Non-resident ID state returns are available upon request. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents. Letter to Internal Revenue Service transmitting Federal Estate 346 Tax Return 30.

A fiduciary must file Form 66 Idaho Fiduciary Income Tax Return when any of the following circumstances apply. Return it isnt required to file an Idaho return. IRS Form 1041 US.

If your estate is large enough you still may have to worry about the federal estate tax though. For more information call the Tax Commission at. If you qualify for an extension to file your Idaho tax return and any extra tax payment must be postmarked or sent electronically by October 15.

13 April 2013 Author. Preparation of a state tax return for Idaho is available for 2995. If the income in.

If the Idaho Fiduciary Income Tax Return Form 66 is filed within the. Enter the total of Idaho distributable income from Form PTE-12 columns b c and e. E-Filing non-resident ID state returns is not available.

Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes. An inheritance tax return must be filed for the estates of any person who died before October 1 1993. Treasure Valley Concerned Over Rise in IRS Estate Tax Audits.

Line 6 Estate Tax Deduction Enter the deduction for federal estate tax attributable to income in respect of a decedent. Include Form PTE-12 with the return if the trust or estate files as a pass-through entity. To qualify you either need to pay 80 of the estimated tax you owe for 2021 or 100 of the total tax reported on your 2020 income tax return she said.

Idaho is considered a tax friendly state. Idaho has no estate tax. For federal purposes taxpayers can increase their standard.

Sole proprietorships or disregarded entities like LLCs are filed on Schedule C or the state equivalent of the owners personal income tax return flow-through entities like S Corporations or Partnerships are generally required to file an informational return equivilent to the IRS Form 1120S or Form 1065 and full corporations must file the. Fiduciary Estate - April 15 - Returns are due by the 15th day of the fourth month following the close of the taxable year. Please contact the Estate Tax Section Illinois Attorney Generals Office with any questions or problems.

The decedent and their estate are separate taxable entities. E-File is not available for Idaho. Which is never good news.

The Idaho tax filing and tax payment deadline is April 18 2022. Form 706 estate tax return. You may check the status of your refund on-line at the Idaho State Tax Commission.

Gross income of 600 or more for the current tax year. Also gifts of 15000 and below do not require any tax payment or estate tax return. You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return.

Letter to Idaho State Tax Commission transmitting Tentative Idaho 345 Transfer and Inheritance Tax Return 29. If the last day for filing any return falls on a Saturday Sunday or legal holiday the return is on time if it is filed on the next work day. Whether or not you have filed an Idaho HOA tax return in past years the process does not seem to ever get simpler.

100 West Randolph Street. We must manually enter information from paper returns into our database. Idaho State Income Taxes for Tax Year 2021 January 1 - Dec.

Idaho State Tax Commission issues most refunds within 21 business days. An estates tax ID number is called an employer identification. Nobody wants to hear from theIRS âand I mean nobody.

Idaho state income tax rates range from 0 to 65. Gross income from Idaho sources of 600 or more for the current tax year. Find IRS or Federal Tax Return deadline details.

Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. Letter to Internal Revenue Service transmitting Federal Fiduciary 348 Income Tax Return 32. If you want to file or pay your taxes online the.

Michigans estate tax is not operative as a result of changes in federal law. Understand typical refund time frames. Resident trust including grantor trust Gross income of 100 or.

Direct Deposit is not available for Idaho.

How To File Taxes For Free In 2022 Money

Tax Form Templates 5 Free Examples Fill Customize Download

How Your Idaho Income Tax Refund Can Process Faster Tax Refund Tax Help Income Tax

You Made A Mistake On Your Tax Return Now What

It S Tax Day If You Re Preparing For Homeownership This Is A Friendly Reminder That You May Use Your Tax Return Toward Yo In 2022 Tax Day Closing Costs Tax Return

Banking Suvidha Income Tax Return Itr Pan Aadhaar Tax Saving F Personal Injury Lawyer Injury Lawyer Estate Planning Attorney

Why Delivering Government It Projects Can Be So Taxing

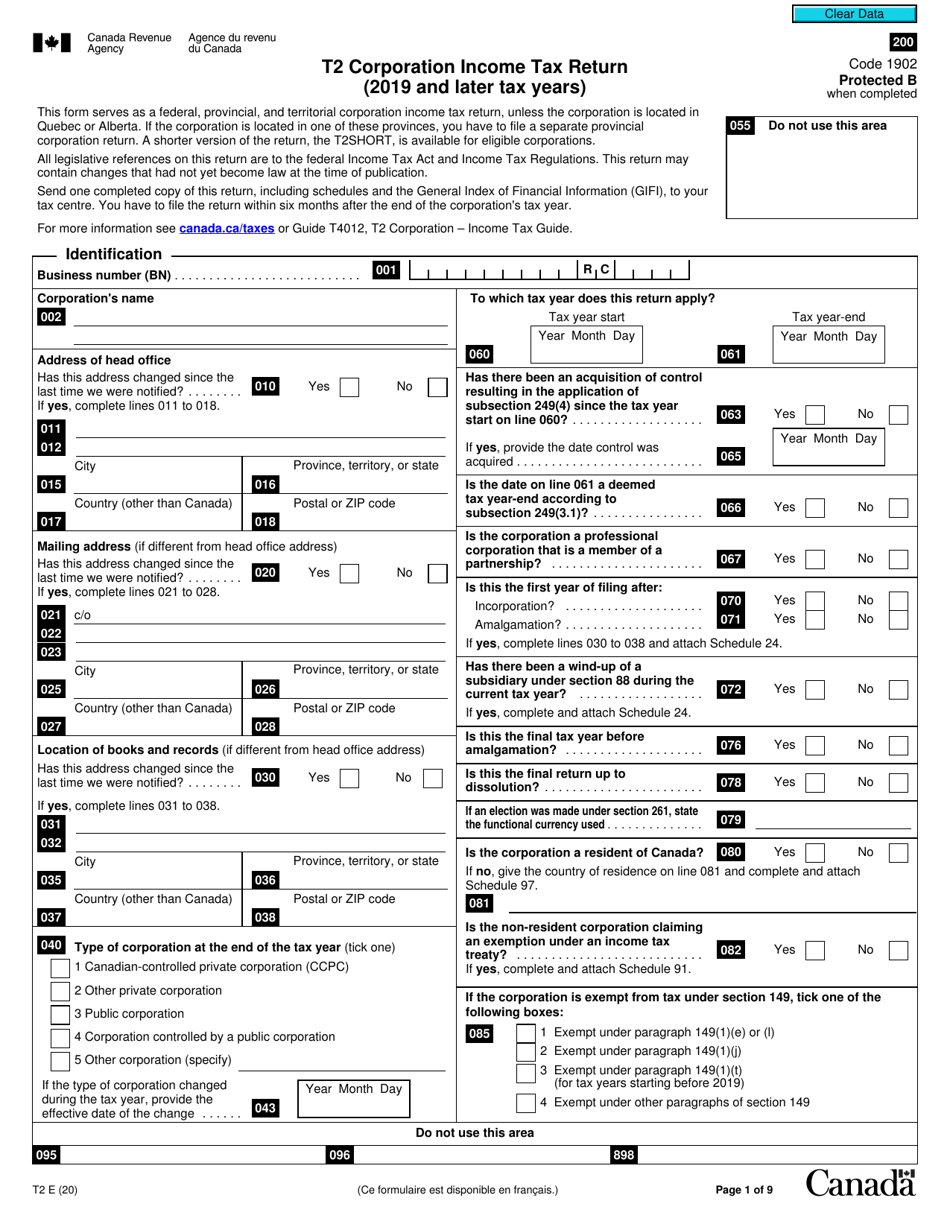

Form T2 Download Fillable Pdf Or Fill Online Corporation Income Tax Return Canada Templateroller

Will The Irs Extend The Tax Deadline In 2022 Marca

Tax Memo Is Sugar Baby Income Taxable Chris Whalen Cpa

It S Time For Your April Home Checklist This Month Is All About Making The Most Of The Warmer Weather There A In 2022 Florida Real Estate Estate Homes Real Estate